1 Start off by registering. Examples of side businesses are plenty including online stores on e-commerce platforms blogging.

Individual Income Tax In Malaysia For Expatriates

On top of that therell be fines of RM1000 to RM20000 if the case is.

. How to Declare Income. On an individual who has left of will be leaving Malaysia in. The amount of income tax payable depends on Bryans tax bracket for 2018.

Calculations RM Rate TaxRM A. Click on Permohonan or Application depending on your chosen language. If youre not sure what counts as income that you have to declare for tax purposes or not scroll down to our section on stating your income below.

Malaysia Tax Rates And Chargeable Income YA 2021. How Much To Pay. How to File Income Tax in Malaysia 2022 LHDNAre you filing your income tax for the first time.

After you reconfirm your information youll get an application number. They will be subject to tax for any foreign-sourced income received in Malaysia effective from 1 January 2022. They can be registered with the Suruhanjaya Syarikat Malaysia SSM whether as a sole proprietor or partnership business as doing so will entitle you to some tax incentives that are inaccessible to taxpayers with non-business income.

For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing. Rental income in Malaysia is taxed on a progressive tax rate from 0 to 30. Statutory Income Declarable by Each Partner.

Go back to the previous page and click on Next. MTD is deducted in accordance with the Income Tax Deduction from Remuneration Rules 1994 or MTD not applicable as income below the deductible level MTD 0. Thats a lot of money people.

On the First 5000. Click on e-Filing PIN Number Application on the left and then click on Form CP55D. The rental income commencement date starts on the first day the property is rented out whereas the actual rental income itself is assessed on a receipt basis.

The laws regarding the tax payment prevalent in Malaysia can be considered fluid and can be adjusted or amended. In Malaysia an individual earning RM34000 after EPF deduction per annum must pay income tax. Fill up the registration form.

If youve just entered the workforce and have absolutely no idea how all this works heres a handy guide. But you can declare your employment income as RM 000 in this way you are not required to pay tax to Malaysia LHDN as you will pay your tax to IRAS in Singapore. A person who has a taxable monthly income of RM283333 approx must register a tax file.

Go to the official registration page and click on Borang Pendapatan Online. This is with the exception of those who carry out partnership businesses in Malaysia. Answer 1 of 5.

With this affected individuals can continue to enjoy the exemption from 1 January 2022 to 31 December 2026. Yes you should submit your e-filing via the LHDN website. Download a copy of the form and fill in your details.

However if you do receive gift or any non-employment in. The answer is Nope. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any information obtained from this website.

They will help you know more about the rules and regulations know how to declare income tax suitable to your gain to. Long answer - If caught by the LHDNs auditor youll face a penalty ranging from 80 to 300 of the taxable amount. Resident individual with employment income and does not.

In Malaysia income tax is compulsory by law and the income tax you pay differ based on your total taxable income for the year. If youre not sure what counts as income that you have to declare for tax purposes weve elaborated more on this in a later sub-section of this guide How To File Income Tax In Malaysia Declare Your Income. Thus Ben and Jerry would be declaring the following amounts of statutory income from the partnership business they own in Malaysia to the IRB.

They can be subjected to review and the final proper guidelines are to be yet issued by the tax authorities. Below are type of forms used to declare income. You must be wondering how to start filing income tax for the.

Each partner is responsible to declare their salaries bonuses interest incomes and share of profits divisible income to the IRB. Simply put if he falls under the maximum income tax of 14 then Bryan would pay a maximum of RM 1652 in income tax payments for his perquisite value of MEGA shares bought under ESOS. On the First 5000 Next 15000.

If this is your first time taking this income tax thing seriously youll need to register first. For example if your total taxable amount is just RM500 now you have to pay RM1500 because of the 300 penalty.

Provision For Income Tax Definition Formula Calculation Examples

P Cecilia I Will Provide Accounting And Tax Services Malaysia For 190 On Fiverr Com Accounting Services Tax Services Bookkeeping Services

How To File Your Taxes For The First Time

How To File Income Tax In Malaysia 2022 Pt 2 Complete Guide To File Tax Returns Lhdn Youtube

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

How To File Your Taxes For The First Time

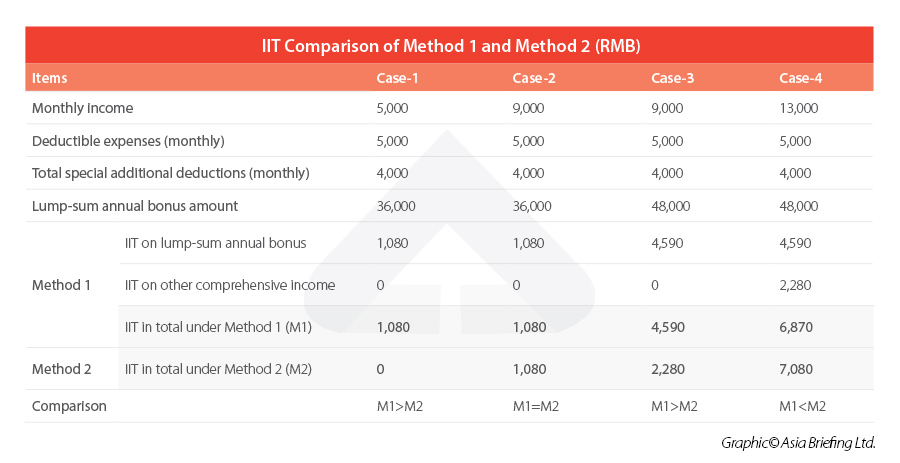

China Annual One Off Bonus What Is The Income Tax Policy Change

How To Create An Income Tax Calculator In Excel Youtube

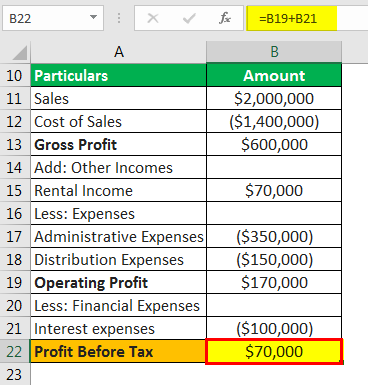

How To Calculate Income Tax In Excel

Provision For Income Tax Definition Formula Calculation Examples

How To Calculate Income Tax In Excel

How To Calculate Your Income Tax Step By Step Guide For Income Tax Calculation Youtube

Top 8 Countries With No Income Tax That You Should Know

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

How To File Income Tax Return For Nri In A Few Simple Steps Ebizfiling

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Watch This Before Filing Income Tax 2022 Pt 1 Complete Guide To File Tax Returns In Malaysia Youtube

How To Calculate Income Tax In Excel

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)